Predicting Sustained Tourism Resumption in Sri Lanka

By – Oliver Martin, Partner and Sam Mountford, Research Director, Twenty31 Consulting

This memo presents an opinion on when we will possibly see a sustained international tourism resumption from major outbound markets including North America, Europe, the Middle East, and Asia Pacific. It is meant to provide a factual, evidence-based opinion to help guide Sri Lanka’s tourism industry as it develops plans over the next three to nine months. The data presented in this memo is based on publicly available information and subject to change daily.

The global tourism industry has, perhaps, been hit harder than any other sector by the COVID-19 pandemic of 2020. Nine months on from the onset of the crisis at a global level, and destinations all over the world are still wrestling with how to respond – how to plan and execute a recovery strategy while the pandemic, and the restrictions put in place by governments across the world to control it, remains very much an everyday reality that has made sustained leisure and business tourism impossible, in all but a handful of cases.

Closed borders and quarantines are the most significant practical obstacles to tourism – but in Twenty31’s judgment, there are several other factors at play.

1. Marketplace Confusion Has Inhibited Travel

The months of the Northern Hemisphere summer saw a cautious resumption of leisure travel (largely domestic) that reflected significant pent-up consumer demand after a long lockdown. But in late summer and early autumn this partial resumption was undercut by widespread resurgences of the virus and mixed messaging from public authorities. Inevitably, this has led to significant consumer confusion, with travellers reluctant to book international vacations while uncertainty remained about whether they would be able to travel to a destination, and whether insurance would cover them if they were not.

IMPLICATION FOR SRI LANKA: Most travel consumers across all of Sri Lanka’s main and traditional international source markets have a high level of confusion around tourism: whether they can travel, what happens when they arrive, whether their insurance will cover them and how to stay safe. Furthermore, there is a high degree of confusion on the protocols around testing and quarantine on arrival back to their respective countries. Destination marketing campaigns will need to wait until the picture for travel consumers becomes clearer. Our strong observation is that current DMO communications are not resonating with travel consumers and this will be the case for at least the remainder of 2020 and into Q1 2021.

2. Residents of Tourism Communities Fear Infection

Despite their heavy reliance on the revenue brought by tourism, many local communities have proved anxious at the prospect of welcoming visitors again and the risk of importing the virus and igniting a local outbreak. PATA research in Asia Pacific cities this highlighted ambivalent attitude towards tourism in a post-COVID environment: seven in ten residents supported continuing promotions to attract more visitors in the future, but the same proportion favoured putting limits on international visitation until the end of 2020. The response of many has been to err on the side of caution, and to seek to discourage tourists from visiting, in contrast with the more encouraging message often being put out by local DMOs.

IMPLICATION FOR SRI LANKA: The future viability of Sri Lanka’s tourism industry will rely on the ongoing consent of its residents and the social contract between residents, the tourism industry, and government. Engagement will be needed to reassure those in tourism communities that all appropriate steps are being taken to screen visitors before arrival and to establish and build awareness of anti-infection protocols that visitors need to follow. But public awareness of the value that tourism brings to these communities also needs to be reinforced.

3. Economic Stress Has Discouraged Many Potential Travellers

The economic decline caused by the pandemic has been profound and sudden, and has had a significant impact on consumer demand, with many potential tourists facing sharply reduced incomes, and an unwillingness to contemplate the discretionary spending associated with a foreign vacation while their financial security is in question.

There are large segments of the international travelling population, estimated at 35% to 65% of total national consumers, who are price-sensitive in selecting destinations and leisure tourism experiences. These same consumers tend to use lower-cost, package and charter-based vacations, which all evidence suggests will take until 2022 to 2024 to recover back to anything resembling 2009 visitation levels.

To compound this, World Economic Forum has suggested that business travel including for small-group meetings, conventions and trade shows will take until 2022 to see any form of sustained recovery given drastic declines in travel budgets and discretionary corporate spending.

IMPLICATION FOR SRI LANKA: With tourism so susceptible to the economic climate – and particularly the long-haul tourism to Sri Lanka from many of its major traditional source markets – this may be another reason for Sri Lanka to seek to rebalance its tourism economy towards new, more local source markets in Asia that may be less susceptible to depressed economic sentiment in the G8 economies. Additionally, Twenty31 strongly recommends Sri Lanka develop and adopt a market segmentation approach to tourism marketing and promotion to attract a high-value, Intrepid Traveller, likely less price sensitive and risk averse. The previous approach of accepting any and all tourists, including from price-sensitive mass-market charter and packaged tour operators will not contribute to tourism recovery in this highly volatile economic climate.

4. The ‘Second Wave’ of European and North American Infections Has Shifted the Narrative Again

Discussions were ongoing in many countries during the summer months about a potential loosening of border restrictions to facilitate a resumption of something closer to normal levels of international tourist traffic. But the steadily worsening infection rates throughout September, which some maintain now constitutes a second wave, have meant that in recent weeks, the narrative has changed.

Tourism authorities have increasingly found themselves on the back foot when it comes to advocating for policies that would allow travel to resume. The debate over testing is a key example. Public health authorities have been setting the agenda, taking the lead from the World Health Organization, which insists on the use of PCR tests as the ‘gold standard’ (i.e. as opposed to rapid on demand antigen testing). But the use of these tests in a travel context presents major practical problems, as they are both costly and slow.

As of 30 October, the major international outbound markets of Germany, France, UK, Sweden, Canada, the US, Italy and Spain are not considered viable source markets of sustained tourism potential until infection rates flatten. Any nascent hope for a resurgence in international outbound travel during the December 2020 to April 2021 holiday period is very likely misplaced.

IMPLICATION FOR SRI LANKA: The key priority for Sri Lanka and other countries reliant on inbound tourism flows is to ensure that the tourism industry’s voice is heard and understood when important policy decisions are made that will help or hinder visitor flows. Sri Lanka should engage constructively with influential representative bodies such as PATA and IATA and support them in working with international health authorities to develop consistent protocols for COVID testing that are internationally accepted and understood by travel consumers. This will be needed for when sustained tourism recovery will happen in late 2021, early 2022.

Looking to the Future: Prospects for an Eventual Return to ‘Normality’ Are Good – But Not Yet

In the short to medium term (i.e. November 2020 to December 2021), prospects for mitigating the spread and impact of the virus and allowing a significant degree of normality to return to life and travel patterns are good. Advances in treatment mean that death rates from COVID-19 have already significantly reduced since the height of the first wave, while other treatments are currently undergoing clinical trials and look to have potential to bring down rates of serious illness and death further.

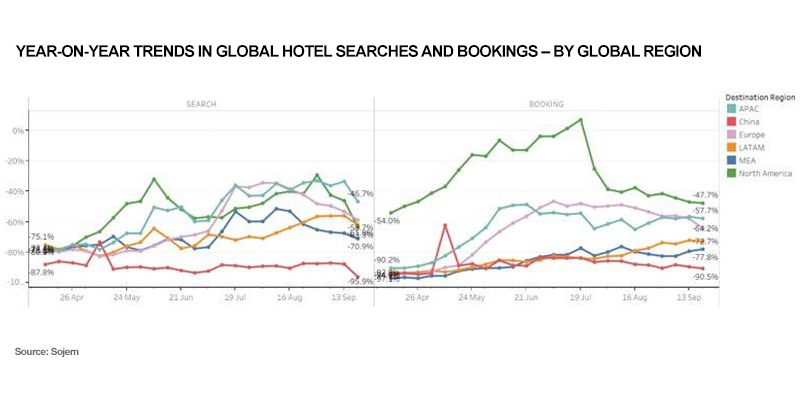

Evidence also suggests that latent demand for travel remains significant. Travel search and booking figures remain well down on 2019 across the world (hotel bookings are down 64% on 2019 in Europe and 48% in North America), but recovered markedly after the initial peak of the virus before falling back again after the summer high season as cases started to rise again. Still, global travel confidence is on a positive trajectory and will continue to rise and fall in response to virus cases.

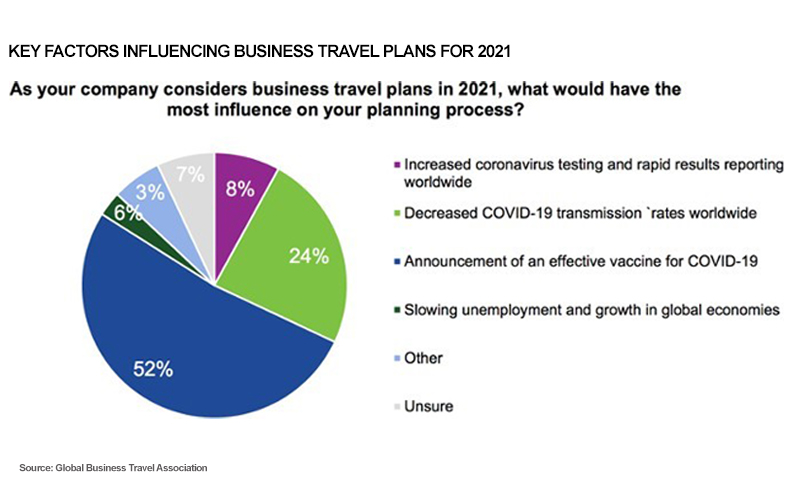

An effective vaccine, of course, is still viewed as the most likely factor to boost consumer and travel confidence. Recent research, as the chart below shows, also suggests that it will also be the main factor behind a return to business travel.

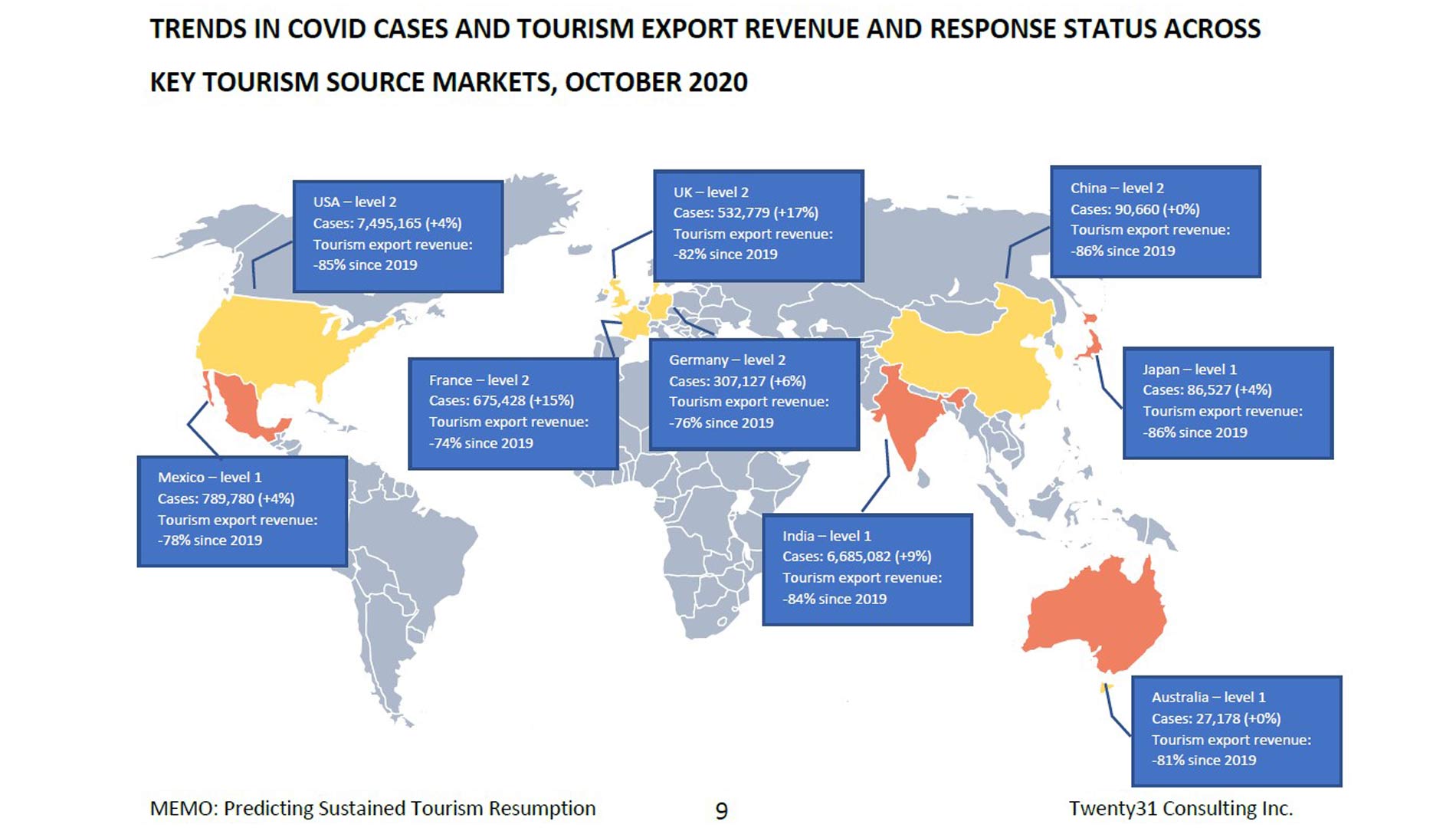

When tourism does start to resume in earnest, in Twenty31’s judgment, it is likely to be consumers in those countries that have most effectively suppressed the virus’s transmission that will be among the first to embrace international travel again – likely the countries in North-East Asia – South Korea, Japan and China. Travellers in the Gulf region may follow, with the major source markets of Europe and North America some way behind. Despite their low levels of infections, Australia and New Zealand may be among the last to resume international travel given the establishment of a travel bubble that will last well into 2021.

For now, however, as the dashboard of selected international source markets below shows, the dominant picture is one where nations are either still at the stage of prioritizing COVID-19 response (level 1) or are predominantly focused only on domestic tourism (level 2) as case numbers continue to rise sharply in Q4 2020 in many markets.

So, What Now?

In Twenty31’s judgment it would be unwise at this time to make major investments in international promotion and marketing for a destination like Sri Lanka which depends on the willingness of consumers to spend significantly, in long-haul source markets that have been profoundly impacted by COVID-19.

As things stand, we might expect a vaccine to have been approved by Q1 2021 and deployed to a critical proportion of the traveller populations in Sri Lanka’s major international source markets by Q1 2022, allowing for discretionary leisure travel to resume at meaningful levels. On this basis, Q3 and Q4 2021 would be the earliest we would recommend embarking on major in-market destination promotional campaigns. Needless to say, these timings remain fraught with uncertainty, subject to events and liable to change.

In the meantime, Sri Lanka should take steps to prepare for sustained tourism recovery. These steps could include:

- Investigating the market dynamics of countries closer to home as potential substitutes for traditional source markets in North America and Europe. These might include North Asia (China, Japan, South Korea), the Gulf region (KSA, UAE) and India.

- Conducting and most importantly implementing a robust, research-based segmentation to identify market segments to target that may be less price-sensitive and risk averse (i.e. Intrepid Travellers).

- Once this is done, identifying and targeting airline and travel trade partnerships to address these key segments (i.e. those marketing to higher-value Intrepid Traveller segments), with a strong focus on operators attracting authentic-seeking cultural and adventure travel consumers, not necessarily only mass-market charter operators.

- Clearly embracing that the world and especially the travel and tourism industry and travel consumer has changed, and that 2019 is not returning. Sri Lanka should take the opportunity to evolve, improve and build back better in terms of institutional changes at SLTDA and SLTPB and the development and implementation of an innovative, evidence-based tourism development and management strategy.